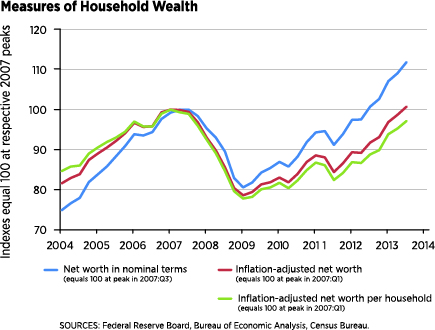

Here’s a statistic that illustrates just how bad the recession was: Despite U.S. households gaining $21 trillion in household wealth since 2009, the average family is still poorer than it was in 2007. That’s right, according to research from economists William Emmons and Bryan Noeth of the Center for Household Financial Stability, the average U.S. household’s inflation-adjusted net worth is $626,800, 2% below its 2007 peak of $645,100.

The green line in the above chart shows the trajectory of the average household’s inflation adjusted wealth. The red line shows non-inflation adjusted wealth per household, while the blue line shows the total net worth of American households–which is about 11.8% higher than its peak in 2007.

The differences are driven by the fact that the population has grown quite a bit since 2007, so while total wealth has more than recovered, per household wealth has not.

Research from Berkeley economist Emmanuel Saez has also shown that the recovery has been more uneven than even these data suggest. According to Saez, 95% of the wealth gains experienced between 2009 and 2012 have gone to the top 1%, which suggests that the median household is even worse off than the average-household figures in the above chart suggest.

Because household wealth is so dependent real estate values, the recovery has also been uneven depending on where you live. Here’s Emmons and Noeth:

“From their low points at the end of the third quarter of 2011, the average house price in California appreciated about 32 percent through the end of the third quarter of 2013 versus about 11 percent in Missouri. In current-dollar terms, this translates into an average increase of more than $$133,000 for a California homeowner versus about $18,000 for a Missouri homeowner.”

In other words, pretty much everything about the recovery has been discriminating. If you live in the right place, have the right skills, and have enough money tucked away to invest in the stock market, the past four years have been very kind to you.

The rest of the country, however, hasn’t been so lucky.