A picture’s worth much more than a thousand words to Facebook. Last April — a year ago today, in fact — the social media giant agreed to buy the quickly growing photo-sharing social network Instagram for a cool $1 billion (the final price, a mixture of cash and stock, was $715 million because Facebook shares tumbled before the deal was finalized). The sky-high purchase price, well above Instagram’s $500 million valuation at the time, led some to wonder if Facebook was helping to fuel another tech bubble. A year later, the jury’s still out on whether Instagram will one day reap huge profits, but the company is laying groundwork to put the monetization machine in motion.

By many metrics, Instagram has had an impressive year under Facebook. The photo-sharing network had about 30 million users at the time of the buyout. Today there are more than 100 million monthly active users posting more than 40 million photos per day. The company has doubled its staff to more than 25 employees, including a new business operations director brought over from Facebook.

Despite the large growth numbers, it’s difficult to say whether Instagram has earned its price tag. The company earns no money and has not talked about monetization strategies its executives are mulling, though CEO Kevin Systrom has said that Instagram’s goal is to become a self-sustaining business. Facebook’s financial support has likely shielded Instagram from some of the financial pressures it would have faced on its own. “If there’s no revenue pressure…maybe they’ll take a wait-and-see attitude,” says Brian Blau, research director in consumer technologies at Gartner. “Their strategy today is more around building infrastructure, setting up their features and functions for the future.”

(MORE: Is Facebook Losing Its Cool? Some Teens Think So)

Still, examining Facebook’s monetization strategies shows Instagram’s likely path to revenue. Josh Olson, an equity analyst at Edward Jones, predicts advertisements will eventually begin cropping up in users’ Instagram streams, similar to the way ads now populate Facebook’s News Feed. “You don’t have to stretch the imagination too far to imagine how they could turn on that monetization switch,” he says. “I think they’re probably holding off on applying that model until they get it right on Facebook.”

So far, Instagram’s one foray into monetization led to widespread backlash. In December, the Internet cried foul when the company announced plans to alter its terms of use to make users’ photos fair game for use in advertisements without compensation. Though Instagram said this was an overbroad interpretation of its new rules, the company quickly backtracked and dropped the offending language about ads. Blau says the snafu was a typical example of Facebook overreach, but it’s unlikely to have long-lasting effect on Instagram’s success.

While users may have concerns about Instagram advertising, brands are excited about the prospect. They’re already leveraging the platform as a visual marketing tool. According to social media analytics company Simply Measured, 59 of the world’s top 100 brands are now on Instagram, compared to 40 back in August 2012. General Electric was on the network a year before the Facebook buyout, and uses its popular Instagram account to appeal to science and technology fanatics. Linda Boff, GE’s executive director of global brand marketing, says ads on Instagram could feel more organic than those on other social networks. “There are opportunities for brands to be smart, to be contextual, to be a bit native on the platform,” she says. “We’re obviously very bullish on it.”

(MORE: 7 Surprising Things Lurking in Online ‘Terms of Service’ Agreements)

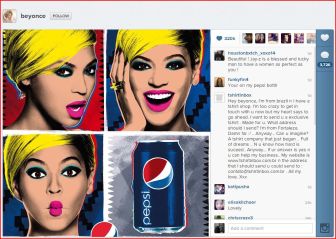

This marketing image for Pepsi posted on Beyonce’s Instagram account got 320,000 likes and more than 3,700 comments.

A nascent advertising market is already emerging, as Ad Age reported last week. Beyonce recently posted a Pepsi ad on her account, and it racked up 320,000 likes, more than many of her more natural photos. Celebrities like LeBron James and Nicole Richie have also uploaded photos that mainly function as sales pitches. “Branded ads are picture-based, and this is a picture-based platform, so I think it absolutely lends itself towards that,” says Uri Minkoff, CEO of fashion apparel company Rebecca Minkoff.

Minkoff hopes Instagram will go a step further than advertising and develop some kind of commercial tool for selling products directly to consumers. Right now photo captions on Instagram can’t include clickable links, making it less useful for call-to-action marketing than visual competitors like Pinterest. “There are so many times, for us in particular, that consumers see the picture and they want to buy the product,” Minkoff says. “I think the sales numbers would be very impressive.” A tool similar to the recently launched Facebook Gifts, which allows people to buy physical goods for their Facebook friends, could make sense on Instagram in the future.

Though Instagram has yet to generate revenue for Facebook, it has already provided some strategic benefits. Had Facebook left Instagram on the market, it would have either evolved into a large competitor on its own or been bought out by a social media rival like Twitter, which offered $525 million for the company, according to The New York Times. Instead of being an adversary, Instagram’s a hip companion to Facebook that’s pulling in a set of users who might not think Facebook is all that cool anymore.

As a mobile-first company, Instagram is also helping expand Facebook’s presence in that emerging social media battleground. In February Instagram’s mobile app had 3.5 million more daily users than Twitter’s official app on iPhone and Android, according to ComScore. It’s now being integrated into Facebook Home, the new social interface launching on Google’s Android operating system. And it’s spawned a host of visually focused, mobile imitators, like Twitter’s microvideo platform Vine and new social network Pheed.

(MORE: The Hidden Cost of Tax Refunds)

Instagram certainly has benefited from having access to Facebook’s financial resources and massive userbase. Whether Systrom and his staff can return the favor and actually produce earnings for the parent company remains to be seen. But analysts today aren’t balking at the large price tag.

“It’s still a very compelling and popular platform,” Olson says. “The brand is very strong and there’s certainly still a lot of momentum around it and a lot of growth potential as well. It’s really just a matter of when they begin to focus on monetization of that platform, they do it in a way that doesn’t alienate their user base.”