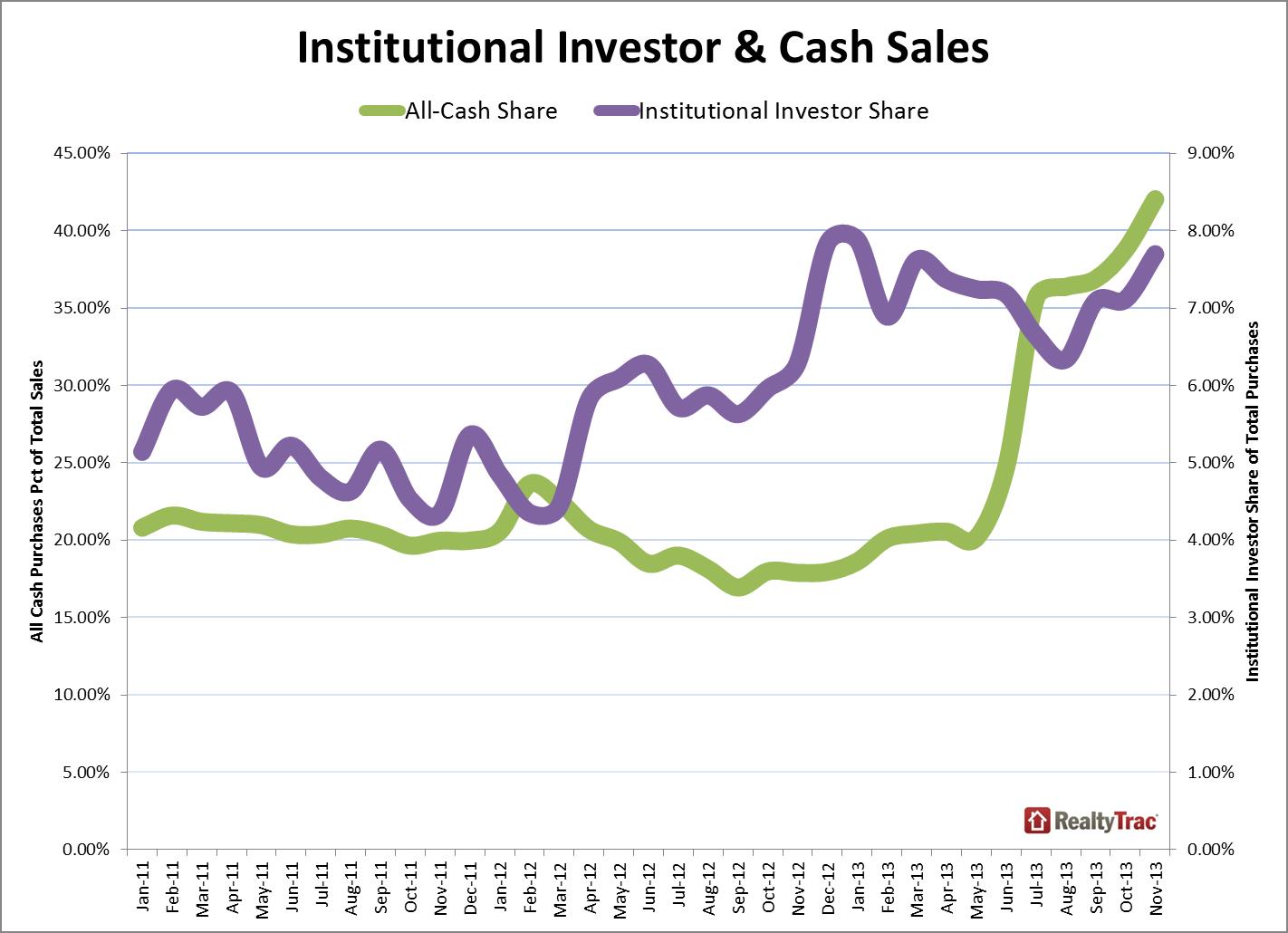

Of the nearly half-a-million homes sold in the U.S. in November, 42% were sold to buyers who paid with cash, according to the latest housing report from real estate data company Reality Trac.

That percentage is the highest since 2011, when Realty Trac began calculating the percentage of all-cash buyers.

As you can see from the chart above, the percentage of homes bought by institutional investors is also close to its all time high.

There are two ways these statistics can be interpreted. On the one hand, seeing such a large percentage of institutional and all cash buyers is worrisome because it says that typical homebuyers–who live in their homes and take out mortgages to finance purchases–don’t have the wherewithal to invest in real estate. It also suggests that banks are still wary to lend to all but the most credit-worthy of borrowers.

On the other hand, it’s good to see that there are investors out there who are confident enough in future economic growth to invest in housing.

Cash-buyers have been big players in the real estate market for many months now, and it can be an annoyance for first-time home buyers who get outbid by cash-rich investors. It’s difficult to say how widespread this phenomenon is, but the statistics, like a recent survey from the National Association of Realtors that says only 28% of new homes were sold to first-time buyers, suggest that the Average Joe is having a tough time in today’s market.

Likely all that’s needed to solve this problem is time. As consumers’ credit recovers from a devastating recession, and as home builders and banks respond to rising demand for housing, the market should return to normalcy.