“Pretty please” probably isn’t going to cut it. You want to be polite but firm, knowledgeable but not a know-it-all. And when the time comes, you might have to threaten to close your account—and it’s best if you mean you’d actually do just that.

Personal Finance Ninja posted his own recent experience getting his bank to waive a fee for dipping below his minimum balance. (Like a lot of people, Mike at PFN didn’t even know he had a minimum balance.)

Here are his negotiations tips for getting bank fees waived, but they’re good pointers for any all-too-common customer service confrontation:

• Be assertive but also be polite. No one wants to help a jerk so don’t start yelling at the customer representative or threatening to close your account (unless you mean it). At the other end of the spectrum, don’t be a pushover either.

• “No” is just a starting point in any negotiation. You’re going to hear “no” a lot if you’re negotiating but be assertive with your demands. Customer representatives are trained to deny your requests multiple times before they are allowed to waive a charge or fee.

• Mention your value as a customer. Companies spend a lot of money on marketing and every customer has an acquisition cost. I guarantee that the fee that you’re trying to get waived is dwarfed by the amount of money the company spends on acquiring a new customer. Bring up the fact that you’re a long-term customer with large deposits and that you’re a nice kid. Believe me, the bank would hate to see you go.

• Ask for a supervisor. No customer representative who cares about their job wants to pass a customer complaint along to a supervisor. If you actually get a supervisor on the line, just try the same things you tried with the customer representative: Ask for what you want. Mention your value as a customer. And be polite and assertive while doing it.

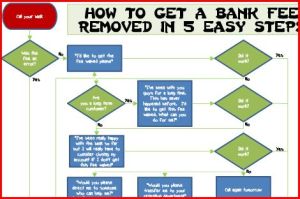

There’s even a step-by-step visual, which you can see part of here (sorry it’s so grainy):

While threatening to close your account can work as a tactic, it can also force your hand and make you do something you didn’t really want to do—and that you might not have really thought out. MSNBC’s Bob Sullivan, in a recent Q&A, said basically the same thing with regards to the cancellation threat, when he was discussing calling up your cable company to get a better deal:

… do one more thing before you call: Get yourself into the frame of mind that you are committed to switching providers if you don’t get an answer you like. Pick a deal from an alternative company that you know will work for you and firmly install that in your head as plan B. This step is essential.

Why? You’ve got to really be prepared to walk away. That way, you’re OK with either outcome (either the customer service rep caves and waives the fee, or you move on and find a better company to do business with.).

If you’re not ready to move on, PFN offers some alternative phrases that get your point across but don’t leave you hanging with no choice but to cancel. Like:

“I’ve really enjoyed the bank’s services up to now but I will really have to consider closing my account if I can’t this fee waived. What can you do for me?”

Saying this raises the stakes by making a subtle threat about leaving the bank but also gives you the option of doing nothing if you choose to do so.

At this point, it might help to mention some info about the bank’s competition (their interest rates, special introductory offers, no ATM fees, that sort of thing), just to make it clear that you’re aware of other options. You don’t want the threat to be all that subtle.