Veteran investor Carl Icahn is opening a new front in his quest to persuade Apple to part with more of its massive cash stockpile.

Icahn believes the technology giant should share more of its wealth with stockholders. So to push Apple, he now wants stockholders to vote on whether the company should spend more of its billions to buy back its own shares on the public market. A buyback would almost certainly drive up the price of Apple’s stock—and increase the value of Icahn’s holdings along with those of all Apple investors.

Icahn tells TIME he filed a shareholder proposal with Apple on Nov. 26, three days before the deadline for measures to be voted on at the company’s next annual shareholders meeting. His measure calls for a share buyback and is in the form of a precatory proposal, which means that even if a majority of Apple shareholders approved, it would not be binding on the company’s management. That’s the typical approach for shareholder resolutions, even those coming from investors who are at odds with management.

For his part, Icahn says he doesn’t consider his proposal an indictment of Apple CEO Tim Cook, or the company’s management, per se. “Tim Cook is doing a good job with the business,” Icahn tells TIME. “I think he’s good whether he does what I want or not.” But, says Icahn, referring to the company’s huge cash stockpile, “Apple is not a bank.”

Icahn has the option of withdrawing his proposal if he and Apple can come to terms. If not, the situation could turn into a proxy fight against Apple, even if it is not a particularly hostile or aggressive one. The two sides would vie to persuade stockholders to vote their way. (The term proxy fight refers to the fact that shares from stockholders who cannot attend the annual meeting in person can be voted by proxy. In practice, waging a proxy fight means persuading big institutional investors to support a measure.)

Apple confirms that Icahn has filed a precatory proposal and, in response to TIME’s query about it, Apple spokesman Steve Dowling said: “Earlier this year we more than doubled our capital return program to $100 billion, including the largest share repurchase authorization in history. As part of our regular review process, we are once again actively seeking our shareholders’ input on our program, and as we said in October, the management team and our board are engaged in an ongoing discussion about it which is thoughtful and deliberate. We will announce any changes to our current program in the first part of calendar 2014.”

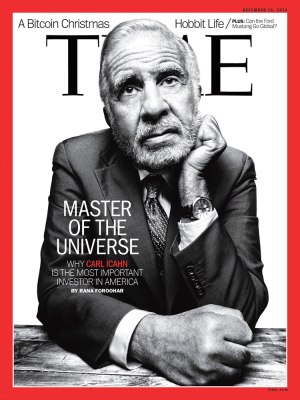

Icahn’s proposal marks a new stage in the clash between one of the world’s most valuable and successful companies and its most formidable shareholder activist. (Icahn, worth $20.3 billion, just edges out George Soros as the top Wall Streeter on Forbes’s list of the richest people in America.) It’s a battle to which TIME has had a front row seat over the last several weeks. In a series of exclusive interviews for a TIME cover story about Icahn and shareholder activism, I have followed Icahn’s efforts to get Apple to part with more of its $147 billion cash hoard. As he told me over dinner and a five-hour interview at his apartment on Oct. 29th–the same dining table where he’d sat with Cook in late September and first proposed a buyback plan– the precatory statement to Apple isn’t about trying to restructure a weak firm. “I’m not against the management of this company. But they’ve got too much money on their balance sheet.”

Apple has already done a $17 billion bond offering (the company decided to borrow the money rather than pay the hefty U.S. taxes required to bring some offshore cash back home) in order to raise funds for a planned $60 billion share repurchase over three years. But Icahn says that’s not enough. In a letter to the company dated Oct. 23rd and posted on his new corporate activism website, shareholderssquaretable.com, Icahn noted that the company trades at a discount to the S&P 500 index despite the fact that it’s a cash cow—Apple will generate around $51 billion worth of free cash next year.

Shareholders, say Icahn, deserve a bigger share. And Cook, he says, has been willing to consider his views. Icahn told TIME: “We’ve discussed a lot of things, and he asked a lot of questions, and really listened.” Icahn says his most recent conversation with Cook was a 20-minute phone call Nov. 21—which Cook’s assistant initially tried to schedule at 5 a.m. Pacific Time. “That’s usually when I go to bed! This guy’s tougher to get than the President,” laughs Icahn.

“A lot of people say Steve Jobs probably wouldn’t have talked to me, and maybe that’s true,” Icahn tells TIME. “But I think he [Cook] found our conversation sort of interesting. He said, `Look, you’ve accomplished a lot, and we want to listen to you.’”

TIME subscribers can read the full cover story Thursday, December 5 at 7AM EST.