Friday’s jobs report was supposed to come out last week, but its release was delayed due to the lingering effects of the government shutdown. The delay in the report’s release, however, won’t be the only way in which it is effected by the shutdown.

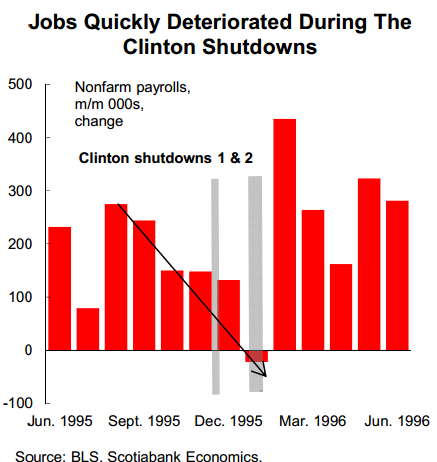

Analysts at Scotiabank foresee a bleak number tomorrow when the Labor Department announces the number of jobs the U.S. economy created in October, mainly because their surveys were conducted “smack dab in the middle of the partial government shutdown.” Scotiabank took a look back to the previous government shutdown during the mid 90s, and found that it lead to the Labor Department actually registering a loss of 6,000 jobs during a time of otherwise decent job growth.

Scotiabank does not predict the same result this time around — it’s forecasting Friday’s report will show about 80,000 new jobs were added in October, though it doesn’t rule out the possibility of a negative number. Unfortunately, it also doesn’t predict that job growth will aggressively rebound in the months after the shutdown as it did in 1996, either. There’s just too much uncertainty in the economy between budget negotiations, another debt ceiling deadline and the implementation of Obamacare for businesses to dive headfirst into serious investment in human capital.

So why does this matter? Friday’s jobs report is just one of many pieces of incoming economic data. But markets tend to react strongly to it because it is perceived as the most important data point for the Federal Reserve. The central bank will meet once more this year, in December, and there’s increasingly a belief among market watchers that it will announce a shift in policy this time around.

In a change from previous Fed meetings, the focus at the next meeting may be lowering the threshold unemployment rate at which it would consider raising short-term interest rates rather than paring back its monthly bond purchases. As it stands now, the Fed has said that it would consider raising short-term rates once the unemployment rate hits 6.5%. But according to a recent Goldman Sachs report, the next big policy change might be to lower that threshold to 6%, in an attempt to keep down expectations for future short-term interests rates which have risen in recent months.

But there are many folks out there that think this is a misguided attempt to avoid the fact that when they do eventually taper bond purchases, it will send markets into a tailspin. Here’s the independent research firm Bianco Research in a note published this week:

“Unsurprisingly, the Fed still does not get it. They are hopeful that by lowering their threshold for the first rate hike to 6.0% unemployment, they will be afforded the luxury of pushing forward with the taper without consequence. This only makes sense if the market believes the level of holdings matters more than the flow of purchases. History has shown the market cares about flows and any taper will be taken badly.”

In other words, regardless of what the economic data say, the Fed has painted itself into a corner by getting markets hooked on a large, monthly purchases of government debt and mortgage bonds, and any paring back of the program will be painful, regardless of how it’s done.